Introduction & Framework

National Cheng-Chi University Risk and Insurance Research CenterIntroduction

- Objectives of Establishment

The Research Center aims to establish a pre-eminent research and consulting team in the field of risk management and insurance in Taiwan. We focus on important current issues that the government and industry face in order to provide recommendations on policy reform and strategic planning. The Research Center recruits outstanding researchers and scholars from different universities across Taiwan. The Research Center also invites renowned international scholars to serve as consultants who assist our research team with their undertaking of research projects or industry consulting work.

- Four Main Research Groups

- Risk Management:

including government natural disaster risk management, enterprise risk management, and financial institutions risk management

- Longevity Risk and Pension:

including population aging, design of pension plan, social insurance retirement benefits, occupational pension, pension fund management, retirement saving, annuity, reverse mortgages, other pension investment products, and issues related to pension management and investment

- Insurance Management and Social Insurance:

including product design, marketing strategy, investment asset allocation, actuarial valuation, asset liability management, risk management of the social insurance systems and insurance company operations, and other issues related to bancassurance and life settlement

- Finance and Insurance Regulations and Supervisory Mechanisms:

including issues related to finance and insurance regulations, designing early warning system and supervisory mechanisms

- Risk Management:

- Development Goals

- International Academic Activities and Research Award:

- Inviting renowned academic journal editors and associate editors to Taiwan

- Inviting the Research Advisory Board members and well-known scholars to Taiwan

- Rewarding research publications in top-tier international research journals

- Providing research grants for center researchers and Ph.D. students to attend international conferences

- Research Projects:

Organizing research teams to undertake research projects for the government and companies. We focus on important current issues in Taiwan, such as financial insurance oversight, pension fund and social insurance policy reforms, financial product innovation, risk management, insurance, pensions, and other related issues

- Industry Consulting Service and Educational Training:

Providing professional strategic operational advisory services and educational training for companies on enterprise risk management, insurance management, pension fund investment and risk management, and other related issues.

- Scholarship Award:

Providing scholarships and internship to excellent undergraduate, graduate students as well as exchange students, and helping companies to recruit potential new employees.

- Conference and Policy White Papers:

- Hosting conference to discuss major controversies and important issues of government policy reforms and market operations in risk management, insurance and pension systems

- Holding regular seminars to seek balanced solutions between practice and theory by exchanging views from different parties

- Publishing Policy White Papers to propose possible government reforms and industry strategy solutions

- International Academic Activities and Research Award:

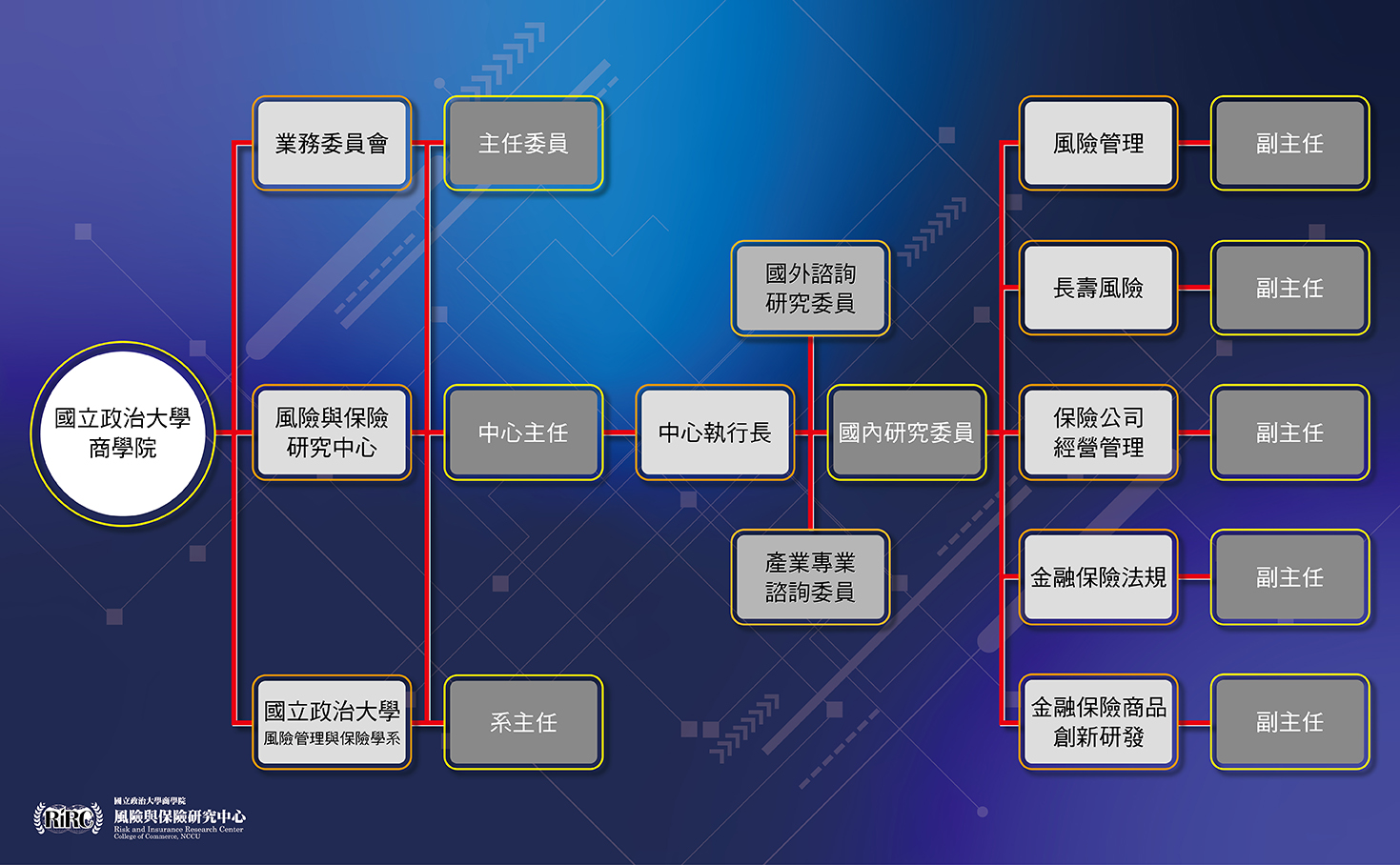

Framework and Chief-Executes of RIRC

Professor Morgan M.H. Hsieh

Professor Morgan M.H. HsiehDirector,Deputy Director of Longevity Risk and Pension

Professor, Department of Risk Management and Insurance, National Chengchi University, Taiwan

Ph.D. in Operations Research, Stanford University, U.S.A Professor Jennifer L. Wang

Professor Jennifer L. WangChairman of the Business Committee

Professor, Department of Risk Management and Insurance, National Chengchi University, Taiwan

Ph.D. in Risk Management, Insurance and Actuarial Science, Temple University, U.S.A Henry Cheng-Wei Wang

Henry Cheng-Wei WangChief Administrator

Lecturer, Department of Risk Management and Insurance, National Chengchi University, Taiwan

Master in Law. Department of Law, National Chengchi University, Taiwan Professor Yung-Ming Shiu

Professor Yung-Ming ShiuRMI Department Chair & Deputy Director of Risk Management

Professor, Department of Risk Management and Inurance, National Chengchi University, Taiwan.

Ph.D., University of Edinburgh, U.K. Associate Professor Vivian S.C. Jeng

Associate Professor Vivian S.C. JengDeputy Director of Insurance Management and Social Insurance

Associate Professor, Department of Risk Management and Insurance, National Chengchi University, Taiwan

Ph.D. in Finance and Insurance, University of Rhode Island, U.S.A Professor Jin-Lung Peng

Professor Jin-Lung PengDeputy Director of Finance and Insurance Regulations and Supervisory Mechanisms

Professor, Department of Risk Management and Insurance, National Chengchi University, Taiwan.

Ph.D. in Business Administration, National Chengchi University Professor Hong-Chih Huang

Professor Hong-Chih HuangDeputy Director of Finance and Insurance Products Development

Professor, Department of Risk Management and Insurance, National Chengchi University, Taiwan

Ph.D. in Actuarial Mathematics, Heriot-Watt University, Edinburgh, UK

Goal and Vision

The Risk Management and Insurance (RMI) Department at National Chengchi University (NCCU) launchs the “Risk and Insurance Research Center (RIRC)” in 2011. RIRC has two major goals: establishing a pre-eminent research and consulting team in the field of risk management and insurance and assisting the government, companies, insurers, and pension funds in Taiwan to better manage their risks. The primary reasons for setting up RIRC are as following:

- Risk management is the key factor in the success of the government and business operations.

The world is facing serious aging and environmental problems. Many countries worldwide have worked hard on the issues of social insurance, annuities, pension plans, and health care. Further challenges are posed by ubiquitous catastrophes and the financial turmoil in the capital markets. To better manage these risks, many companies have established risk management departments and asset-liability management committees as well as appointed chief risk officers. The financial markets developed effective tools for risk management as well, including catastrophe bonds and mortality-linked securities. Governments also proposed various policies and regulations to address relevant issues. There is still much to be studied and developed though.

- Longevity risk poses a great challenge to the pension fund and many financial institutions in Taiwan.

The population growth rate in Taiwan in 2009 is 0.37%, the lowest rate in the record. On the other hand, the dependency ratio (the number of elder people supported by a working person) reaches its record high to 13% and is predicted to be 34.13% in 2036. Therefore, the social insurance system, pension fund and financial insurance industry of Taiwan face strict challenges, especially if interest rates remain low and the mortality improvements continue. Recent innovations in the financial markets such as survivor bonds, reverse mortgages, and pension swaps may help. Resolving these problems however demands much effort.

- Taiwan’s financial and insurance markets has a significant position in the world.

The government of Taiwan has successfully promoted national health insurance, national annuity insurance, labor pension, compulsory automobile liability insurance, earthquake insurance, and other fundamental society insurance since 1990s. The private insurance markets boomed rapidly as well. The total assets of the insurance industry to those of all the financial institutions is 21.53% in 2008. The insurance penetration ratio (the ratio of the insurance premium to GDP) was 16.42% and ranked the first place in the world. The insurance density ratio (the amount of annual premium per person) was 2,787.7 dollars, which is ranked the 19th place in the world. These statistics demonstrate the maturity and significance of the risk management and insurance markets in Taiwan.

- The research performance of the RMI department at NCCU is ranked the best in Asia

The number of papers written by Taiwan scholars and published in the leading international journals (Journal of Risk and Insurance, Insurance Mathematics and Economics and Geneva Risk and Insurance Review) grew significantly. In terms of this number, Taiwan would be ranked the fifth in the world and the first in Asia. Moreover, the RMI department at NCCU is ranked the number-one department in both Taiwan and Asia.

Facing the aforementioned risks and challenges, the Taiwan government and financial industries can certainly benefit from the academia. The RIRC aims to establish a pre-eminent research and consulting team in Taiwan. We recruit outstanding researchers and scholars from the universities across Taiwan and invite renowned international scholars as well as industry experts to serve as consultants. RIRC will study essential issues in a timely way to propose policy reforms and efficient solutions to the government and industries, in addition to promote the interactions between the international insurance academia and the insurance academia of Taiwan.

國立政治大學風險管理與保險研究所榮獲全球前50名最佳風險管理與保險研究所之排名

Chairman of the Business CommitteeJennifer L. Wang

Director of RIRCMorgan M. H. Hsieh